What’s all the Buzz about?

Investing in high-income, Specialist Disability Accommodation (SDA) as a part of the National Disability Insurance Scheme (NDIS) is something that more and more investors are demonstrating interest in. But why?

We all love a great outcome! And generating incomes of up to $96,000 per tenant, with multiple tenants in the one house is up there which more than most can expect when investing in residential property.

But how realistic is it to achieve this outcome? And how do we go about understanding the best approach to give us the chance of achieving it? This article has been designed to assist in identifying the high-level requirements of SDA investing and what you should know before deciding to proceed.

How does it work?

As of today, around 25,000 people with a disability in Australia are living within SDA homes. This number is expected to grow to over 36,000 by the year 2042. Unfortunately, the number of people with a disability in Australia is growing at a considerable rate (see key stats below).

Key statistics

Disability

- 5.5 million Australians (21.4%) had a disability, up from 17.7% in 2018.

- 15.0% of people aged 0-64 years had a disability, compared with 52.3% of people aged 65 years and over.

- Disability prevalence was similar for males (21.0%) and females (21.8%).

- 7.9% of all Australians had a profound or severe disability.

In 2018, 1 in 3 (32%) people with disability had severe or profound disability (about 1.4 million).

Source: ABS

The challenge for our government, is that a proportion of these people will need specialist disability accommodation to support their vulnerabilities. As of now, we have more people with a need for SDA than we have houses available. This means that the Government is housing vulnerable people in aged care and hospital accommodation at a higher expense, in an environment that does not provide the support that these people require and deserve. This approach is currently costing the Government more than $3B per year.

The Solution:

Following a thorough review process, the Government decided on the SDA model, which concentrates on incentivising privatised investors to assist in delivering more specialist accommodation on a larger scale. Not only does this reduce the initial outlay to construct the properties for the Government, but it costs a significant amount less annually than housing people in aged care centres and hospitals. Of the $41B budgeted to the NDIS per year, around $700M per year has been allocated to funding SDA homes across the country.

In 2014, the NDIS scheme was launched with the main type of housing solution provided being converted houses to support SDA participants. Recently, it was announced that legacy stock of this nature, along with larger group housing solutions of 4 and 5 tenant arrangements will be discontinued in time to allow for specialist building of 1, 2 and 3 tenant housing solutions.

The Workings of SDA Investing:

First of all, it is important to understand that not any builder can build an SDA home. Special licenses are required to ensure that your builder can build the house to the required specification, quality and design parameters. You also need to ensure that compliance and the appropriate certification is in place, otherwise you risk the house being declined by the NDIA and that may lead to losses as your returns will be less.

Secondly, it is critical to understand that leasing out an SDA home is different to a traditional property and can take longer to onboard an occupant. As a guide, it takes approximately 100 hours to onboard an SDA approved participant before they can enter the home and your income begins. This often comes with a cost to the investor as SDA managers usually charge a fee to conduct this work.

Once your property is built, and registered with the NDIA (circa 4-8 weeks from handover), tenanting an SDA home is the most important element of your investment. There are a range of different considerations that are needed with tenanting an SDA house.

- Location: People with disabilities want convenience as well. This means that they’re attracted to premium locations with supporting amenities and resources over regions without these features. When an SDA tenant is approved for funding, housing options are provided – and they choose where they want to live based on what’s available. Something close to water, medical facilities, shops and transport is more appealing than a house in a remote location .

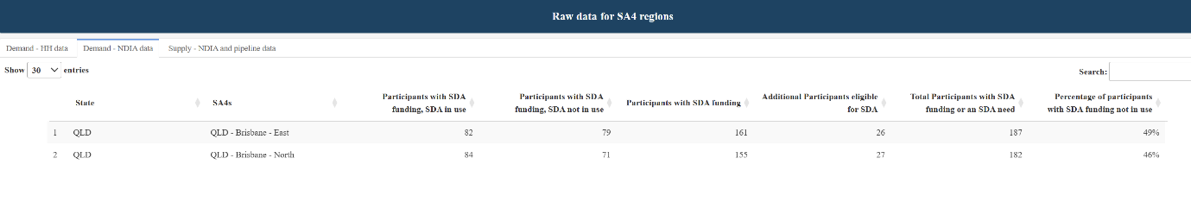

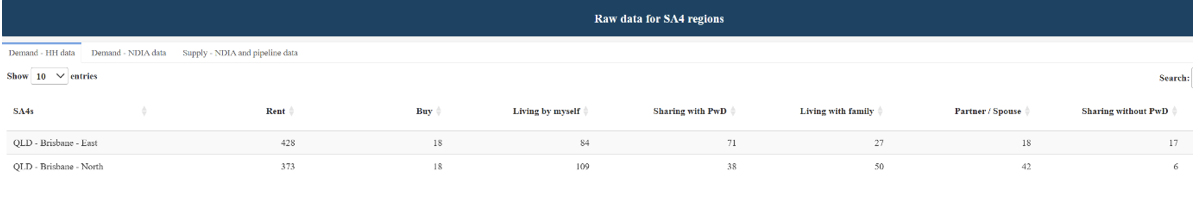

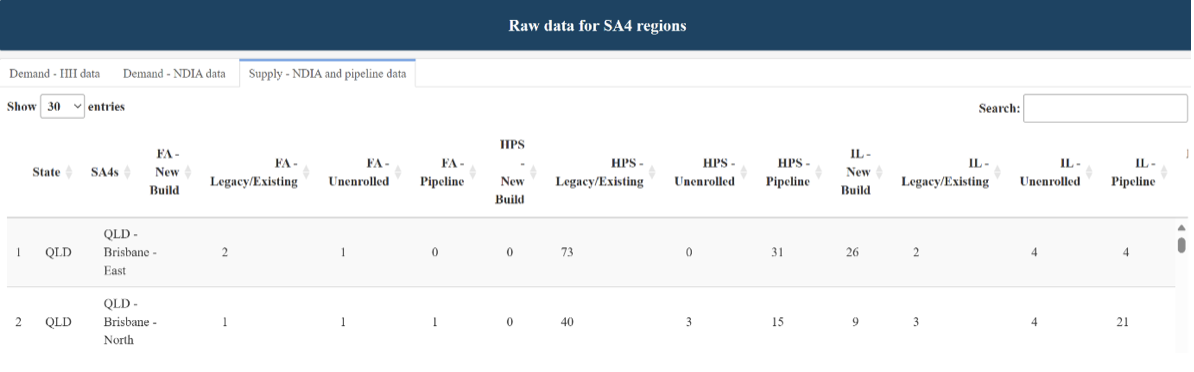

- Demand: Not all regions have high demand. As mentioned above, SDA participants want quality of life and location is important to achieve that. Understanding which areas have a high demand is critical before deciding to invest in SDA.

- Supply: Coupling with demand, if there are 50 more SDA houses in a region than tenants with funding, then naturally the investor is at a disadvantage and the time to get a tenant is likely going to be longer. If there are only 10 SDA houses and 50 occupants with funding, then we know that the investment has a much better chance of being tenanted and in a timely manner.

- Aligning with the right providers: It is important to understand that traditional property managers cannot manage an SDA property. You need a licensed SDA manager who complies with the regulations of the NDIA. It is also important to understand that other providers who you will not communicate with (such as SIL providers) play a critical role in tenanting your property. A failure to prepare properly with these providers can mean a longer delay in tenanting your investment and lost dollars.

- Discussions with providers before building: Before any NDIS property is presented to clients of BuyFair Property Group, discussions with the right providers such as SDA managers, SIL providers, heads of hospitals and more are conducted to give our investors the best chance of success.

- Assessing the data: BuyFair Property Group invests in acquiring key data and assesses this before providing any property for consideration. The data provides more insight into what’s happening within an area for both supply levels and demands across the different categories and regions. An example of how this data may look is below.

All of the above approaches require the correct resources and expertise to assess properly. Investing blindly as a guess in NDIS can be extremely risky and leave you with an empty home and a lot of unwanted overheads. It is critical to work with providers who discuss all the above elements and demonstrate the ability to assess any investment thoroughly.

Categories: There are 4 categories that can be funded through the SDA.

- High Physical Support (HPS): Housing that has been designed to incorporate a high level of physical access provision for people with significant physical impairment and requiring very high levels of support.

- Robust: Housing that has been designed to incorporate a high level of physical access provision and be very resilient, while reducing the likelihood of reactive maintenance and reducing the risk to the participant and the community.

- Improved Liveability (IL): Housing that has been designed to improve ‘liveability’ by incorporating a reasonable level of physical access and enhanced provision for people with sensory, intellectual or cognitive impairment.

- Fully Accessible (FA): Housing that has been designed to incorporate a high level of physical access provision for people with significant physical impairment.

It is important to know that some houses built to the HPS certification levels will also be accessible to people with IL and FA funding. Taking this approach can open the possibility of getting tenants in various ways.

High Physical Support Design Category - Housing that has been designed to incorporate a high level of physical access provision for people with significant physical impairment and requiring very high levels of support.

Robust Design Category - Housing that has been designed to incorporate a high level of physical access provision and be very resilient, while reducing the likelihood of reactive maintenance and reducing the risk to the participant and the community.

Improved Liveability Design Category - Housing that has been designed to improve ‘liveability’ by incorporating a reasonable level of physical access and enhanced provision for people with sensory, intellectual or cognitive impairment.

Fully Accessible Design Category - Housing that has been designed to incorporate a high level of physical access provision for people with significant physical impairment.

The Funding & The Returns:

Providing that your house is tenanted with SDA approved occupants, there will be two types of payments an investor will receive.

#1: Maximum Reasonable Rent Contribution (MRRC):

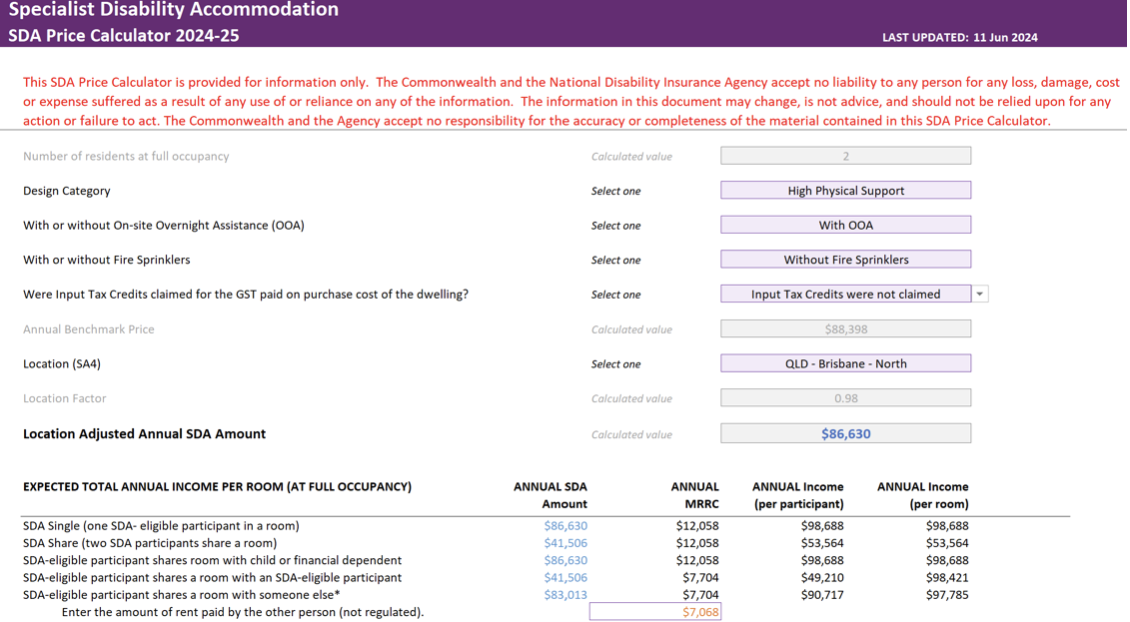

The reasonable rent contribution is made by your tenant/s and paid monthly. Your tenant will pay the agreed amount (currently $12,058 per year) to support the holding of the property. Currently, the MRRC is connected to CPI and will change annually in connection with CPI numbers nationally.

#2: Annual SDA amount (Government funding):

The amount that you are paid from the Government will depend on the category of funding your tenant/s have access to. For example, if you have built a HPS for two tenants and overnight onsite assistance (OOA), and your applicant has Improved liveability funding, should you accept this application then you will receive the appropriate funding based on that tenants approved rates.

You will also receive a monthly payment by Government meaning that you will receive two payments each month.

People often ask whether being paid is guaranteed. This is not guaranteed unless you have approved tenants in the property. This agreement is 20 years between you and the Government from the date of registration of the property. You cannot have an approved tenant move in until the full onboarding of the property has occurred. This will usually take 4-8 weeks following handover of your property.

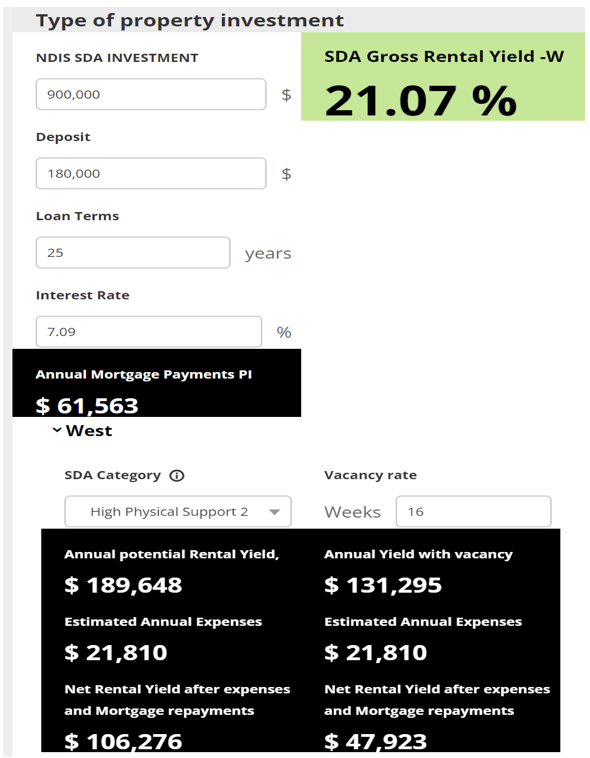

Overall Returns:

Gross income and profit/loss will vary dependant on the package and its category/region + deposit contributions to the investment. BuyFair can assist you in understanding the potential of each investment. Inputting potential vacancy into any property should occur also to understand the good and lesser outcomes that may occur.

The costs:

Like any investment, you will have expenses to manage that need consideration before investing. Naturally, you need to be in a position to manage these expenses before you should consider investing in any property. You would also be wise to have contingency amounts added to the assessment to allow for delays in getting tenants or being paid.

Some of the main expenses you should expect and consider are:

- Mortgage: Usually P&I loan over 25 years

- SDA onboarding costs: $0 - $4,000/$8,000 per tenant

- SDA management costs: circa 10-15% of gross annual income

- Council and Water Rates: circa $3,000 - $4,500 annually

- Commercial insurance: $2,500 annually

- Maintenance: Case by case

- Land tax: state dependant

NDIS Lending:

An important part of NDIS investing is the funding. Like most investments, consumers will most likely require lenders to give funding to support the purchase. Knowing where to go and who to approach with NDIS lending is important. As most lenders won’t take into consideration the extra costs to construct a property of this nature and the income that it can achieve.

Specialise lenders in this space are rare. So, approaching the right lenders will be critical to your success.

Terms with NDIS funding normally sit higher than traditional lending. At the time of writing this article (August 2024), an 80% LVR NDIS loan will usually have a borrowing rate of low 7%’s and be P&I over 25 years. This will usually come with some form of risk fee that’s attached to the lending terms also (similar to LMI).

An NDIS home also requires a specialist valuation approach to ensure that it’s valued correctly. Building an NDIS home is circa $100,000 - $150,000 more than building a normal spec home. If this is valued through a traditional approach, you can expect a low valuation and decline with your lending application. Commercial valuers of certain types know how to value these properties correctly and will position you better with sourcing approvals to proceed.

As all lending, the terms will vary depending on an investors personal position of strength and ability to repay a loan. Buyfair will introduce you to the appropriate lenders and valuers who will support your investment with the correct lending structures and valuations.

Conclusion, Is NDIS worth investing in?

As always, we say that it’s case by case and down to personal preference. Are the opportunities for success exceptional when done right with NDIS investing worth it? We believe so, but understanding inherent risks that may arise with NDIS investing is critical also. Can you hold a property that may be vacant for longer than a traditional property? Keeping in mind that lending costs will usually be higher than a traditional property investment. If yes, and you understand the ins and outs of an NDIS investment (more complicated than traditional investing), then we invite you to reach out to us to discuss the potential opportunities.

![[Aug/2024] Top Most Searched Housing Developments in Australia](https://files.openlot.com.au/p/styles/500h/s3/article/Thumbnail%20-%20Australia%20Top%20Most%20Searched%20Housing%20Developments%20%282%29.png.webp?itok=tZHYIZoJ)